TPP pushes Made in America

Just last week, I had the privilege of listening to Raj Bhala, author of TPP Objectively, and the only man I have come across to have read almost all of the 6000-paged trade agreement known as the Trans-Pacific Partnership Deal (TPP). Mr. Bhala recently moderated an informational panel over the trade agreement, which is known as the “Biggest Deal in History.” It incorporates 12 countries including the United States, Mexico and Canada. The trade agreement was signed in February 2016 after seven years of negotiations! Featured speakers included Christina Sevilla, Deputy Assistant U.S. Trade Representative for Small Business at the Office of the U.S. Trade Representative (USTR), Executive Office of the President and Kate Mellor, International Economist in the Office of Trade Negotiations and Analysis at the US Department of Commerce (DOC).

My Thoughts

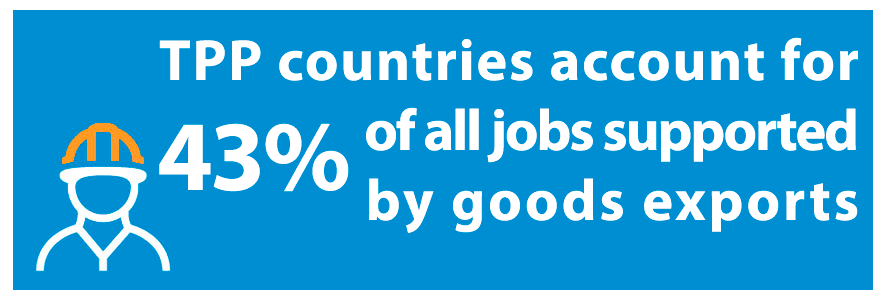

I found the TPP to be fascinating and I was influenced greatly by the speakers. Instantly after I learned of all the benefits, I felt the urge to tell our clients the potential this will have on their goods. The TPP will open up markets and force down barriers that were put in place in the 1930s and years following. There is a large amount of benefits for the United States exports market, as well as our partner countries to import American-made goods and services at much lower duties and taxes. I see this being a big proponent for being “Made in America,” and I personally fully support the deal. Not only will we see lower taxes on our goods, but this agreement will allow us to trade on an open internet with full e-commerce benefits in other countries. The agreement will make it easier to trademark and patent intellectual property in other nations, and protect those small- to medium-sized businesses that make up the majority of our nation.

Did you know?

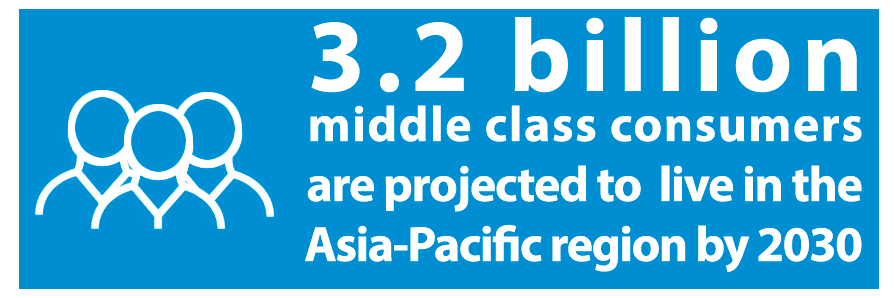

Did you know that 95% of our consumers are outside of the United States? If you take the population of the world, then this truly makes sense. According to the United States Trade Representative (USTR), the TPP will eliminate or reduce tariff and non-tariff barriers across substantially all trade goods and services. Remember that 6000 page agreement I mentioned? It includes what duty rates and non-tariff eliminations that are in place for each commodity in each country. The USTR mentions that the TPP will facilitate the development of production and supply chains — that’s because it promotes services such as engineering, information technology, consulting, among others.

The Midwest is a huge Exporter

It was especially interesting to learn that there are over 4,000 firms just in Kansas and Missouri alone that already export to TPP partners, which include Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, United States and Vietnam.

What if it doesn’t pass?

It just wouldn’t be good. We are now just waiting for it to pass U.S. Congress in hopes it will pass before the current Administration changes. The other TPP countries will continue to do business, free trade, and increase their markets, while the U.S. will essentially keep its walls up. It simply wouldn’t be smart for the good of our people and opportunities in regards to U.S. exports and lower taxes and duties. We will continue to import at very low duty rates that are in place for imports, while our exported goods and services will be taxed a exponentially high rates. When I say high rates, metals exported from the U.S. face tariffs as high as 35% for example. That’s high! How can we be competitive in a world market with duty rates as high as that? The TPP deal will eliminate tariffs on 94.8% of metals and ores immediately upon implementation.

A Tool Designed for You

One of the things that came out of the TPP and the USTR promoting such a deal, is the fact that they themselves modernized in ways to make it easier for firms across the nation to learn more about the deal and start exporting in foreign markets, thus growing their business and bottom line. Kate Mellor, who will be speaking at our next webinar, is the Department of Commerce lead on TPP industrial goods sector analysis and outreach as well as International Trade Association’s FTA Tariff Tool.

One of the things that came out of the TPP and the USTR promoting such a deal, is the fact that they themselves modernized in ways to make it easier for firms across the nation to learn more about the deal and start exporting in foreign markets, thus growing their business and bottom line. Kate Mellor, who will be speaking at our next webinar, is the Department of Commerce lead on TPP industrial goods sector analysis and outreach as well as International Trade Association’s FTA Tariff Tool.

The FTA Tariff Tool is designed to help U.S. companies, large and small, take advantage of export opportunities with U.S. FTA partners. The “What’s My Tariff” search empowers the user to perform instant and at-a-glance searches for tariff treatment for all goods under certain U.S. FTAs. Furthermore, the ITA created fact sheets and guides narrowed down by state or industry, where a firm can see what potential benefits they have in that great big world of ours. The TPP will only help these U.S. firms by giving them the opportunity to work with many great nations.

FTA Quickstart Guide FTA Tariff Tool TPP by state & sector

Webinar Recording

Known as the Biggest Trade Deal in History The Trans-Pacific Partnership (TPP), a trade agreement between 12 Pacific Rim countries with many benefits. For more information or questions, contact info@scarbrough-intl.com.

Question and Answer Forum: Trans-Pacific Partnership from Scarbrough International on Vimeo.

*Click to view the answer on our YouTube channel.

| What is TPP? |

What impact do you foresee in the US Auto sector?

Can we choose between TPP or NAFTA?

Will other countries to join TPP in the future?

Can countries like Malaysia become a TAA?

Will duties that are fogiven be by HTS code?

How soon will TPP go into effect?

When will TPP finalize by law?

What is the approval process in the senate?

Will the forgiven duties be automatic?

Do all countries need to ratify the agreement?

What are the chances that a country will want to amend the agreement?

Who is to determine the duty forgiven of a product?

Will the election affect TPP success?

Will our product be more competitive with TPP?

How will currency manipulation be in TPP?

Is there a site to know which HTS numbers will be duty free?