Importers of COVID-19 Supplies

Submit Comments for Duty Exemptions Now

As a result of the COVID-19 pandemic and shortage of medical supplies in the United States, the United States Trade Representative is requesting public comments on possibly removing duties from additional medical-care products. The USTR has already granted exclusions on various items needed during this time. These exclusions were posted in the Federal Register on March 10, March 16, and March 17, which include personal protective equipment and other medical-care items. Importers of COVID-19 supplies should submit comments as soon as possible.

The USTR states, “each comment specifically must identify the particular product of concern and explain precisely how the product relates to the response to the COVID-19 outbreak. For example, the comment may address whether a product is directly used to treat COVID-19 or to limit the outbreak, and/or whether the product is used in the production of needed medical-care products.” Moreover, comments may be submitted even if the product is already pending an exclusion request or has previously been denied.

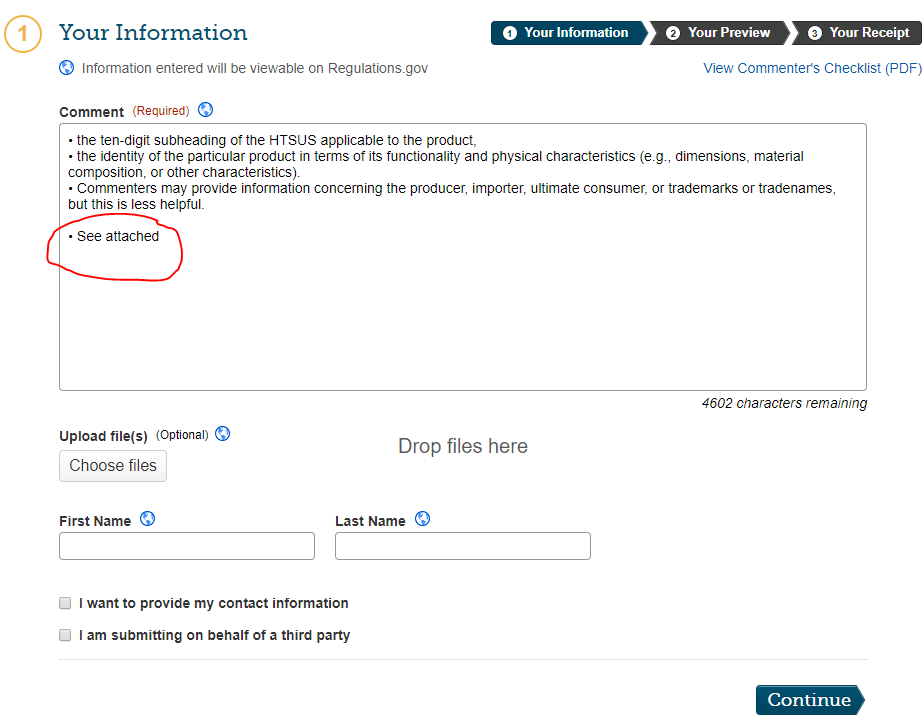

Comments must Include:

- the ten-digit subheading of the HTSUS applicable to the product

- the identity of the particular product in terms of its functionality and physical characteristics (e.g., dimensions, material composition, or other characteristics)

- Commenters may provide information concerning the producer, importer, ultimate consumer, or trademarks or tradenames, but this is less helpful.

- Comments must be in English.

- Comments must be sent electronically by following the directions below.

- If you have an attachment to upload, please type “see attached” in the comments field.

- Upload of attachment in a .doc or .pdf format preferred. If you use a different application, please indicate that in the comment field

- The uploaded file name should reflect the name of the person or entity submitting the comments

- Do not attach separate cover letters, annexes, or exhibits. Use the comments sections for any additional information you could like to include.

Dates

- The docket for comments will remain open at least until June 25, 2020 [with the possibility of extension]

- Interested parties should submit comments as promptly as possible.

- Any responses to comments should be submitted within three business days after a comment is posted in the docket.

How to Submit Comments

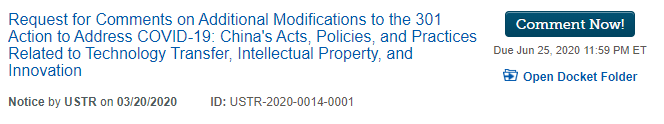

- Submit comments through the Federal eRulemaking Portal: http://www.regulations.gov (Regulations.gov).

- Enter docket number: USTR-2020-0014

- Click search

- Find a reference to this notice

- Click the link that states “Comment Now“

View Federal Register Announcement, click here.

What to do

Scarbrough Consulting, Inc. wants to help in any way we can. If your company has medical-related items or personal protective equipment that need duty exemption, let us help you submit comments as soon as possible.

More over and regardless of COVID-19, Scarbrough Consulting, Inc. continues to offer a free 30-minute consultation to any company that may be affected by the Section 301 announcements. Our company is deemed a critical infrastructure by the Homeland Security, and we will continue to operate during this epidemic. Please send an email to consulting@scarbrough-intl.com or fill out the form below. Our Global Trade Experts and Licensed Customs brokers are here to help.

Consulting Request

Background on Section 301 Tariff Actions

On August 18, 2017, USTR initiated an investigation into certain acts, policies and practices of the Government of China related to technology transfer, intellectual property and innovation (82 FR 40213). During the investigation, the Trade Representative determined that the acts, policies and practices of China under investigation are unreasonable or discriminatory and burden or restrict U.S. commerce, and are thus actionable under Section 301(b) of the Trade Act of 1974, as amended (Trade Act).

In response, President Trump initiated a number of actions which imposed ad valorem tariffs on certain imports originating in China. Four separate lists have been announced. To view the most up to date information, check out our debriefing on Section 301 Imports from China. This post indicates effective dates, duty rates, and more.