Paying U.S. Customs via ACH

Paying U.S. Customs via ACH

Automated Clearinghouse (ACH) allows a payment to be pulled directly from a bank account. We suggest importers pay their U.S. Customs duty and taxes direct to U.S. Customs via ACH. It is a quicker, more seamless process with many benefits.

Benefits of ACH

- No more checks. Auto pay debit or credit with CBP (we suggest debit, so CBP does all the work when it comes to collecting payment)

- Instant “credit terms” with CBP (plus the option of Periodic Monthly Statement – PMS)

- Applying for ACH may create the opportunity to receive better credit terms with Scarbrough

Learn more in our Q&A Session on October 16, 2019 @ 1:30 pm. [maxbutton id=”28″ url=”https://scarbrough-intl.zoom.us/webinar/register/WN_hqBDbjIvR3eTZJBVl6SFKw” text=”Register Now” ]

How does it Work?

A “statement” is the means for triggering an ACH payment. First, a “statement” is provided to the importer by U.S. Customs. This “statement” shows a list of entries released on the same date. It also includes the duties and fees owed to U.S. Customs and Border Protection.

Who should Apply?

- An importer with high duty.

- An importer with moderate to high volume

- An importer that does not currently have credit with their U.S. Customs broker, but wants to apply for credit terms.

How to Apply?

You can either download the U.S. Customs Form 400 here or contact our ACH team. We can make this process as simple as possible for you, if you follow these instructions:

- Email ach@Scarbrough-intl.com and our ACH team will provide the U.S. Customs Form 400

- Scarbrough ACH team will fill out as much as they can for the client

- Scarbrough ACH Team will send Form 400 to client for final completion

- Return completed form to ach@Scarbrough-intl.com

- ACH team will send application to U.S. Customs

Next Steps

When U.S. Customs assigns a Payor Unit Number, this information is sent back to the email address that is listed on the application. The importer needs to forward this information to Scarbrough. Our ACH Team needs the Payor Unit Number to complete the process. After the ACH team receives this number, they will make adjustments to client’s organization in our system and voila, duties will be paid via ACH.

[maxbutton id=”35″ url=”https://thescarbroughgroup.com/wp-content/uploads/2019/08/For-Clients-ACH-PMS-Scarbrough.pdf” text=”Click here to download printable version (PDF)” ]

Next Question

Do you as an importer want Periodic Monthly Statement (PMS)?

What is Periodic Monthly Statement (PMS)?

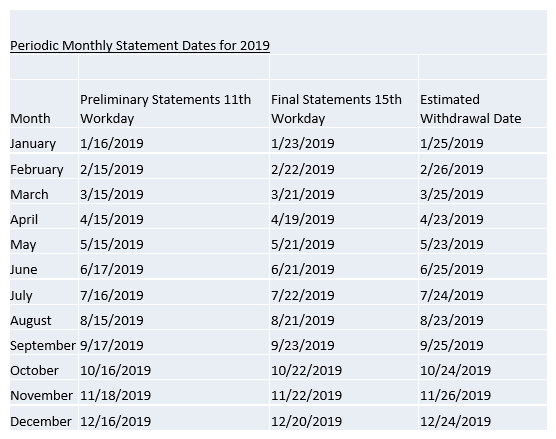

A Periodic Monthly Statement provides the ability to make periodic duty payments on an interest-free monthly basis. It allows an importer to consolidate payments and receive up to 6 weeks of credit. An importer will continue to receive the daily statements as in ACH, however they do not need to pay until monthly statements are processed. The PMS is still based off the release date. The “prelim statement” prints on the 11th workday of the following month and the “final print” or “final statement” prints on the 15th workday of the month. For example, shipments that release in May 2019 will be paid on a June 2019 PMS statement. See the benefits and example schedule below.

Benefits of PMS

- Depending when the shipment releases, credit terms can be up to 6 weeks*

- PMS consolidates all duty payments for the month into one statement (vs. ACH where the payment is pulled from account each time)

- Payment to CBP is due the following month vs. same month as shipment release

- Applying for ACH/PMS may create the opportunity to receive better credit terms with Scarbrough

What do you mean up to 6 weeks?

Paying U.S. Customs via PMS allows importers to extend payment terms of duty up to 6 weeks, dependent upon release date.

- If shipment releases May 6, 2019, it will print on preliminary PMS statement on June 16th

- Final PMS statement prints on June 21st

- 45 calendar days

- Non PMS statement, payment date would be May 17th

If a shipment released on May 30, however, the prelim PMS statement would still print on June 16 and final payment on June 21. The PMS comes out the month following release on the same date regardless when the released occurred.

Example of U.S. Customs Periodic Monthly Schedule for 2019

CBP will post the monthly dates at the beginning of each year so you know when to expect payment initiation.

Let’s Move Forward

Scarbrough does the heavy lifting for you. We will fill out majority of the application for you and submit it to US Customs. Email ACH@scarbrough-intl.com if you want to sign up.

Oops! We could not locate your form.

Online Q&A Session

Join us in an online Q&A Session. Learn the benefits and process from an experienced U.S. Customs broker and Trade Compliance Consulting firm. Ask questions via live chat or submit them ahead of time by emailing ktaylor@scarbrough-intl.com. Can’t make it to the online session? Register anyway to obtain a free recording and resource guide.

[maxbutton id=”38″ url=”https://scarbrough-intl.zoom.us/webinar/register/WN_hqBDbjIvR3eTZJBVl6SFKw” text=”REGISTER NOW” ]